In this topic

Introduction

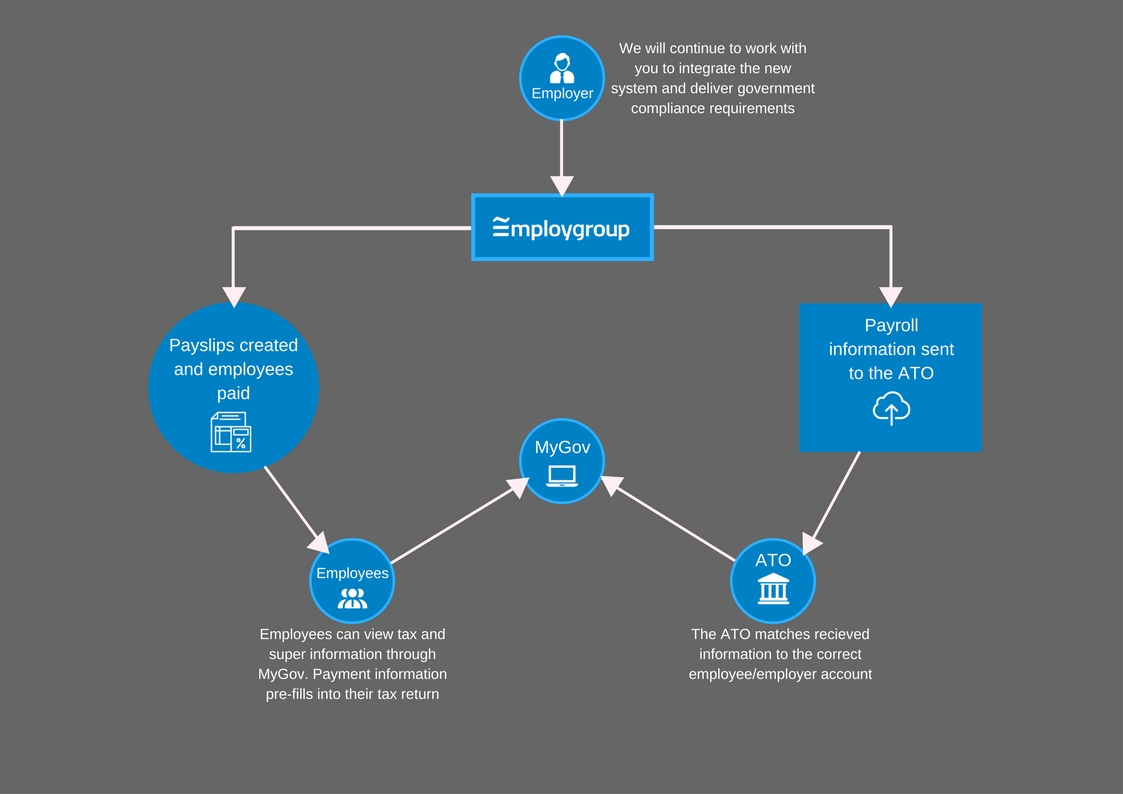

Single Touch Payroll (STP) is one of the biggest tax reforms since the GST was introduced 18 years ago. STP will provide real time visibility for employees into the accuracy and timeliness of their payroll details and it will streamline employer business reporting obligations and centralise information relating to salary and wages, pay as you go (PAYG) withholding tax, and superannuation information in a single online site (MyGov).

STP reporting is mandatory from 1 July 2018 for employers with 20 or more employees and from 1 July 2019 for employers with 19 or less employees.

Under STP, employer payroll information will need to be forwarded to the ATO at the same time (or before) your employees are paid.

Once enabled, our STP solution is already configured to automatically submit STP data to the ATO when you finalise your payroll.

The following topics describe STP in more detail:

| Topic | Description |

|---|---|

| Authorisation | This topic describes the STP authorisation for Ready pay (powered by ePayroll) clients. |

| LINK NOT FOUND | This topic describes how you can enable STP on your account. |

| LINK NOT FOUND | View the STP webinar recording and download the presentation slides. |