In this topic

Introduction

We’ve worked hard to minimise the impact of Single Touch Payroll on your payroll processing procedures.

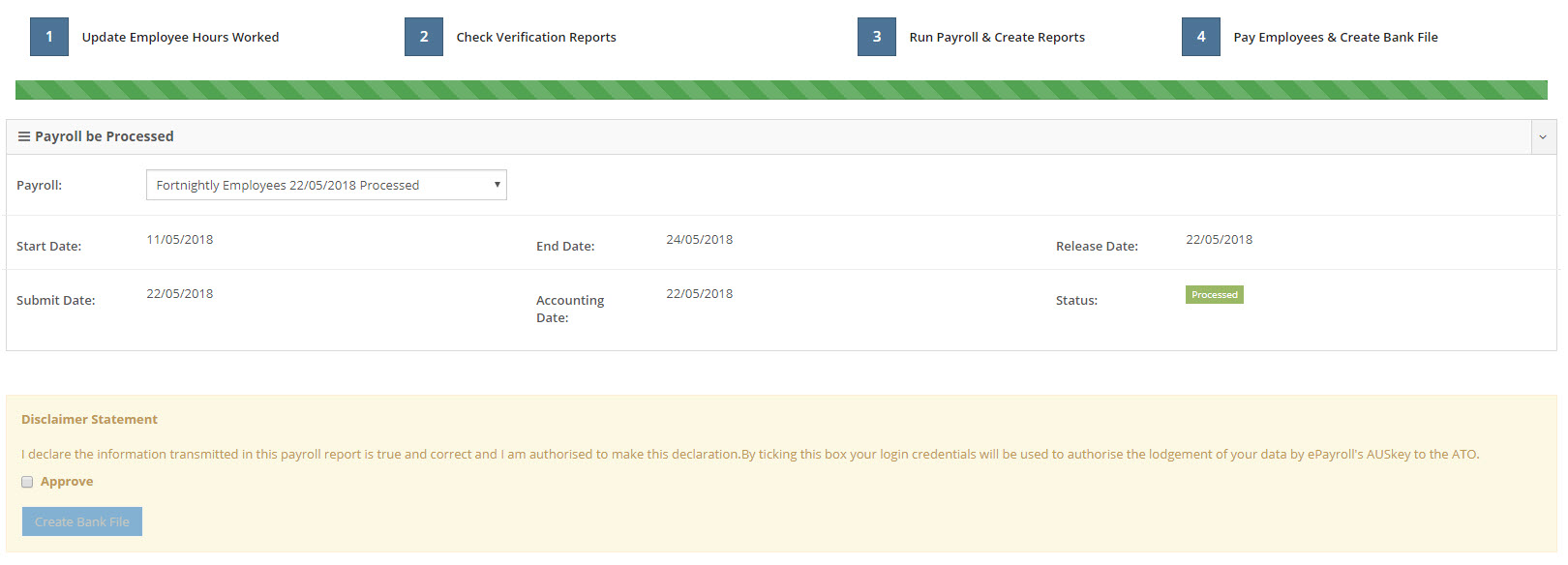

The key change to your normal payroll process is the addition of an STP Declaration at Step 4 of the payroll process.

Running a payroll under STP

You’ll need to run your payroll to Step 4 by following the instructions on the Processing a Normal Payroll help topic.

At Step 4, you will see an STP Declaration, which allows you to authorise the sending of the payroll data to the ATO.

To finalise your payroll, you will need to:

- Tick the Approve checkbox.

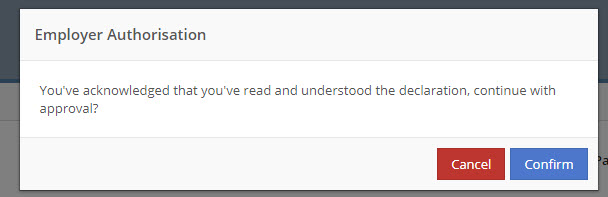

- Click Confirm in the dialog box.

- Click the Create Bank File or Mark as Paid button to finalise your payroll.

NOTE: If your account has been STP enabled, you will not be able to finalise your payroll without authorising the payroll data to be lodged with the ATO.

IMPORTANT: If you pay your employees using a method outside the Ready pay (powered by ePayroll) system (e.g. cash, cheque, manual bank transfer), to ensure that you are STP compliant, you will need to ensure that the release date of your payroll matches the date that your employees will be paid and you will need to finalise your payroll in Ready pay (powered by ePayroll) before making the payments to your employees.