In this topic

- Introduction

- Viewing Taxation Details for an Employee

- Editing an employee’s Taxation Details from within view mode

- Editing an employee’s Tax Details using the shortcut menu

- Tax Variations

- Working Holiday Makers

- Income Stream Types

- Tax Treatment Codes

- Pay adjustments

- Historic Tax Details

Introduction

This topic describes how to view or update an employee’s Taxation Details.

Viewing Taxation Details for an Employee

To view an employee’s Taxation Details:

- Go to the Employees screen using the menu

-

Use the search filters or the page navigation links at the bottom of the screen to find the employee if required

NOTE: For more details on locating an employee record, refer to the Searching for Employees help topic.

- Click on the employees name to view the employees record

- Select the Taxation tab

-

You will see the employee’s Taxation Details.

NOTE: For security reasons, you will not be able to see the employee’s Tax File Number (TFN), however, you will be able to see whether or not the employee has provided you with a TFN.

Editing an employee’s Taxation Details from within view mode

To edit an employee’s Tax Details from within view mode:

- Follow the instructions above to access the employee’s Tax details

- Click the Edit button at the bottom right of the screen

- The Taxation screen will be displayed in edit mode

- Update the details as required

- Click the Save Changes button at the bottom right to save your changes

Editing an employee’s Tax Details using the shortcut menu

To edit an employee’s Tax Details using the shortcut menu:

- Go to the Employees screen using the menu

- Use the search filters or the page navigation links at the bottom of the screen to find the employee if required

- Hover your mouse cursor over the Edit button next to the employee’s name

- Click the Taxation Methods link in the fly out menu

- The Taxation screen will be displayed in edit mode

- Make the required changes to the Taxation Details

- Click the Save Changes button at the bottom right to save your changes

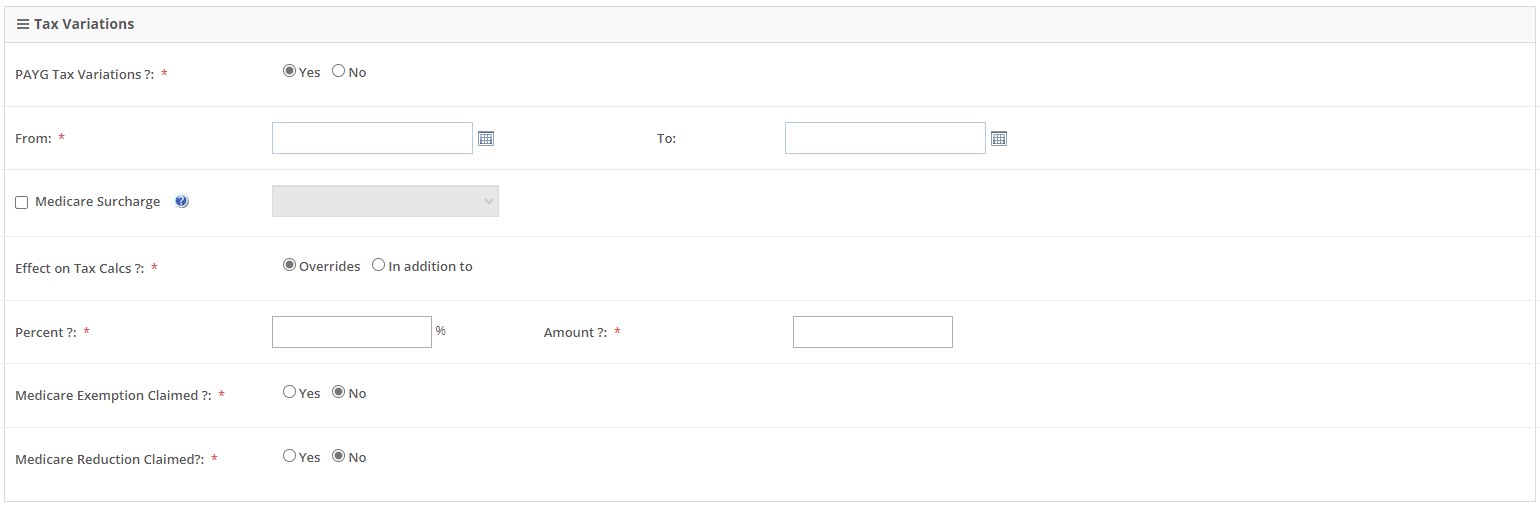

Tax Variations

NOTE: A tax variation that reduces an employee’s tax witholding should only be entered into the platform after you have recieved a written notification from the Australian Taxation Office. An ATO tax variation will typically only be valid for a single financial year.

To add or edit a Tax Variation:

- Access the Taxation edit mode using the above instructions

- Go to the Tax Variations section of the page

- Select Yes at PAYG Tax Variation?

-

Enter From and To dates:

NOTE: The tax variation will be applied to any payrolls which have an Accounting Date that falls between the From and To dates.

- If the employee is liable for a Medicare Surcharge:

- Tick the Medicare Surcharge checkbox, and

- Choose the appropriate Tier from the dropdown

- At Effect on Tax Calcs?:

- To override the system’s tax calculation, select Overrides

- To deduct additional tax, select In addition to

- Enter either:

- An Amount to deduct a certain amount of tax

- A Percent to deduct tax at a specified rate

- If the employee needs a Medicare exemption applied to their tax calculations, select ‘Yes’ at Medicare Exemption Claimed.

- If the employee needs a Medicare reduction applied to their tax calculations, select ‘Yes’ at Medicare Reduction Claimed.

- Click the Save Changes button at the bottom right of the screen

NOTE: A tax variation only applies to normal salary and wages. Termination payments and payments that are taxed as an Additional Payment (e.g. bonuses) will not typically have the tax variation applied to them.

Working Holiday Makers

Any employer can hire a working holiday maker, especially when they need labour for a short period. You can identify a working holiday maker as they will hold a Working Holiday visa (subclass 417) or Work and Holiday visa (subclass 462).

Working holiday makers are taxed at 15% from the first dollar earned, regardless of their residency status. Working holiday makers can’t claim the tax-free threshold and must provide their tax file number (TFN). If they don’t, you need to withhold tax at the top rate.

NOTE: To employ a working holiday maker you must register with the ATO to withhold tax at the working holiday maker tax rate before making your first payment to them.

After you have registered with the ATO as someone who employs Working Holiday Makers, you will need to contact us to advise us. We’ll update your account so that you can specify that an employee is a Working Holiday Maker on the employee’s Taxation Methods screen.

When specifying that an employee is a Working Holiday Maker, you’ll need to choose their country of origin at the Country dropdown.

Income Stream Types

An Income Stream Type groups amounts paid (and taxed) to employees into categories based on an employee’s tax and employment situation at the time of payment.

The possible Income Stream Types are:

| SAW: Salary & Wages | Most employees will fall into this category |

| CHP: Closely held payees | Individual is a related to employer entity. Only available when there are fewer than 19 employees of the business. |

| WHM: Working holiday makers | Employees on specific working holiday maker visa’s. The country of origin must be specified at the Country field for these employees. |

| FEI: Foreign employment income | Where an employee is paid in Australia but working in a different country for an extended period. The destination country must be specified at the Country field for these employees. |

| IAA: Inbound assignees to Australia | Where an employee is working in Australia for an extended period but is paid in a different country. The country of payment must be specified at the Country field for these employees. |

| SWP: Seasonal worker program | For payment made under a special regional employment program. |

| VOL: Voluntary agreements | Where there is a written agreement with a contractor to make PAYG payments. |

| LAB: Labour Hire (Contractor) | For payments made under a Labour Hire contractor agreement. Seek professional advice before using this code. |

| OTH: Other | Special payments by government departments. |

NOTE: The Income Stream Type for each employee is automatically identified based on the tax configuration entered for the employee.

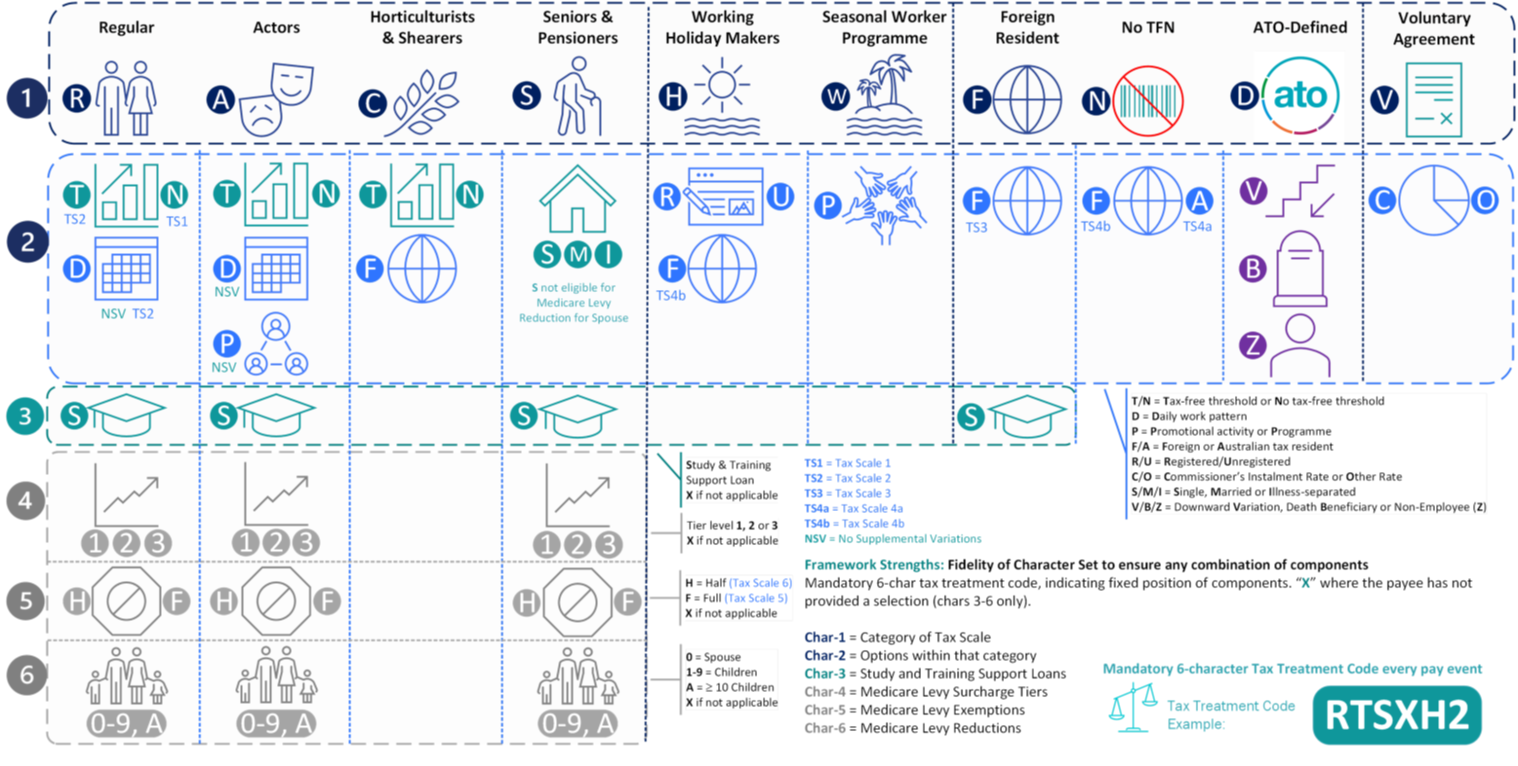

Tax Treatment Codes

The tax treatment code is a 6-character code that advises the ATO of an employee’s current tax declaration. This code is sent to the ATO with every payroll.

NOTE: The Tax Treatment code for each employee will be automatically calculated based on the tax settings that are specified for the employee.

The following table, provided by the ATO, details the structure of a tax treatment code.

Pay adjustments

From time to time, adjustments to past payments are required.

As payments are reported through STP against an Income Stream Type, it is important to make sure that any adjustments are made against the Income Stream Type through which the income was originally attributed.

You can use the Transaction Data (Excel) Report to identify the employee’s Income Stream Type at the time of the original payment.

If it is different to the employee’s current Income Stream Type you may need to consider:

- Backdating the adjustment

- Modifying the current settings that drive the Income Stream Type to change what it is currently

- Doing a two-step adjustment, for example when income was originally attributed to the wrong Income Stream Type

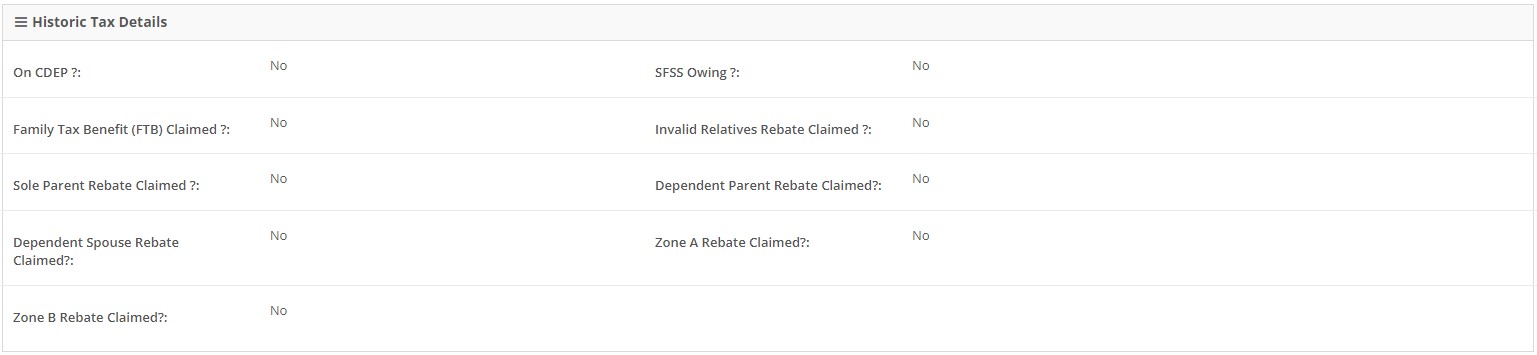

Historic Tax Details

The Historic Tax Details section displays the configuration of any tax items which should no longer be used but have kept in the platform to ensure historical audit reporting is available.

These settings should all be set to ‘No’.