In this topic

Introduction

Not a Wageloch customer yet? Provide your details here to be contacted by an expert on this integration and partnership.

This topic describes how an employer can integrate Wageloch with Ready pay (powered by Aussiepay).

Wageloch is a third party time capture and award interpretation application.

Interpreted timesheet data can be exported from Wageloch into Ready pay (powered by Aussiepay) for processing each pay period.

Note: Whilst we work closely with Wageloch to ensure that this help topic is kept up to date, the following information is provided as is. As Wageloch is a third party product Wageloch may make changes within their platform which aren’t immediately reflected here. Should you have difficulty following steps in this documentation that relate to Wageloch, please seek the assistance of Wageloch’s customer service team. If changes are required to this documentation, choose the ‘sad’ face icon in the left hand menu then provide the details of what needs to be updated.

Integration Options

Through our partnership with Wageloch, you can easily bring interpreted payroll data into Ready pay (powered by Aussiepay) for payroll processing, removing the need for manual data entry.

This can be achieved through file import/export or automated API.

File-based Payroll Data Integration

The file-based integration uses the Ready pay (powered by Aussiepay) ‘CSV file with Alt Rate’ format to bring in payroll data.

This file format contains a row for each payment that needs to be made, including:

- The employee code of the employee the payment relates to

- The cost centre that the payment needs to be allocated to

- The paycode that the payment relates

- The number of units/hours for the payment

The file is exported from the Wageloch platform after reviewing the pre-submission reports.

You should review the data carefully in the pre-submission reports to ensure that the file is accurate. We do not recommend opening the file to make an edit as this may stop the file from importing into Ready pay (powered by Aussiepay).

To configure the Wageloch file-based integration, you will need to ensure that your Cost Centre and Paycode codes in Wageloch are mapped to the correct codes those from Ready pay (powered by Aussiepay). This mapping is completed in Wageloch.

Your employee codes will also need to match in both systems. If there are descrepancies in the codes using across the two platforms, Wageloch should be updated. If employee codes are updated for an employee in Ready pay (powered by Aussiepay) after they have had a pay reported to the ATO through Single Touch Payroll, changing the employee code in Ready pay (powered by Aussiepay) will result in multiple income statements showing in MyGov.

To obtain a list of the relevant codes from your Ready pay (powered by Aussiepay) account, please contact your Payroll Consultant to request a Payroll Upload Codes report. If you have more than one employer record in Ready pay (powered by Aussiepay), the codes will be different for each one. You will require a separate report for each employer.

To import the file into Ready pay (powered by Aussiepay):

- Log into Ready pay (powered by Aussiepay)

- Go to the Payroll -> Open Payrolls screen

- Click the Upload Data button

- If you have more than one pay cycle, ensure the correct payroll is selected in the Payroll dropdown

- In the Payroll File section, click the Choose File button and choose the file that you exported from Wageloch

- In the Payroll File Section, click the Upload button

- Review the Event Listing for errors

After the file has been successfully imported without errors, you can run your payroll. Refer to the LINK NOT FOUND help topic for more information about running your payroll.

Note: If there were any errors, they will need to be fixed and then the file will need to be imported again.

Note: When importing a file, it will override any data that is already in the payroll.

API-based New Employee and Payroll Data Integration

The API integration enables your Wageloch and Ready pay (powered by Aussiepay) platforms to seamlessly ‘talk’ to each other without the need to manually import and export data.

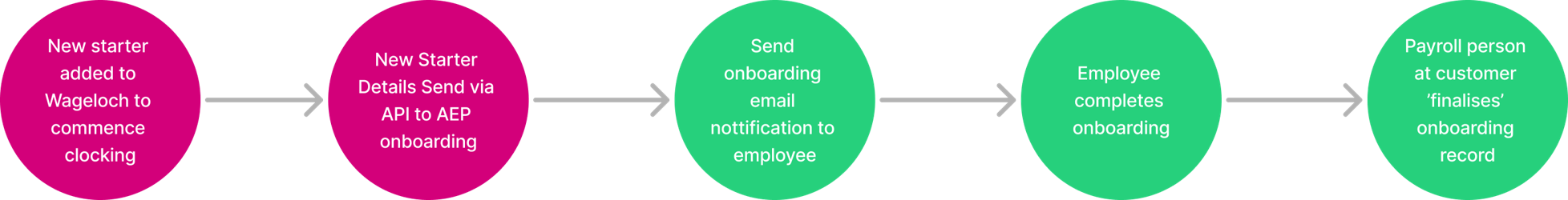

New Employees

Wageloch can seamlessly trigger an onboarding flow in Ready pay (powered by Aussiepay) for new starters when they are added into the Wageloch platform.

This flow guarantees that employee codes will match in both platforms, reducing the likelihood of issues between the platform and eliminating manual updating of employee codes across the two platforms.

Payroll Data

The API-based payroll data integration seamlessly syncs your payroll data into Ready pay (powered by Aussiepay) without needing to manually export and import files.

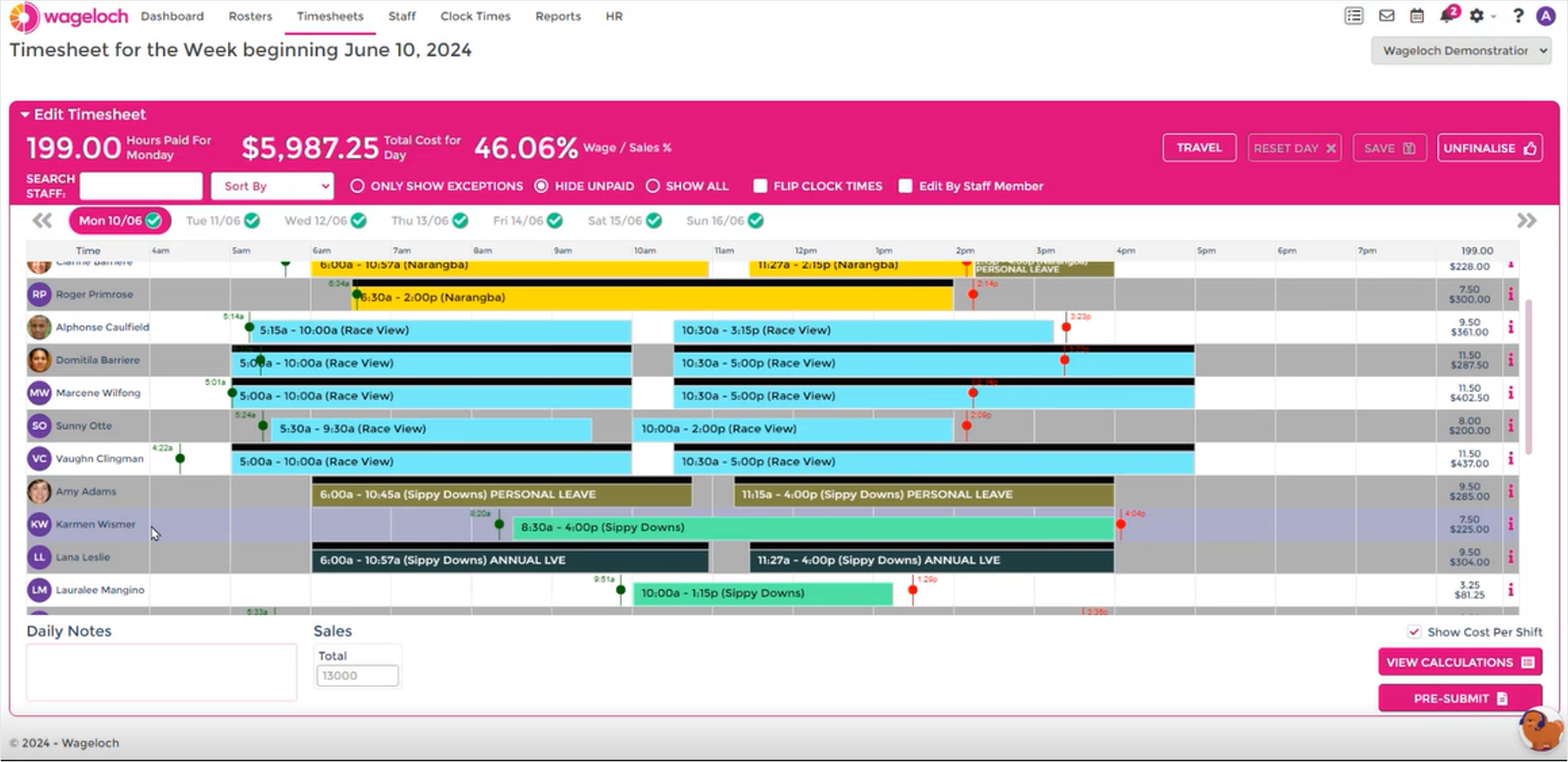

To push the payroll data into Ready pay (powered by Aussiepay):

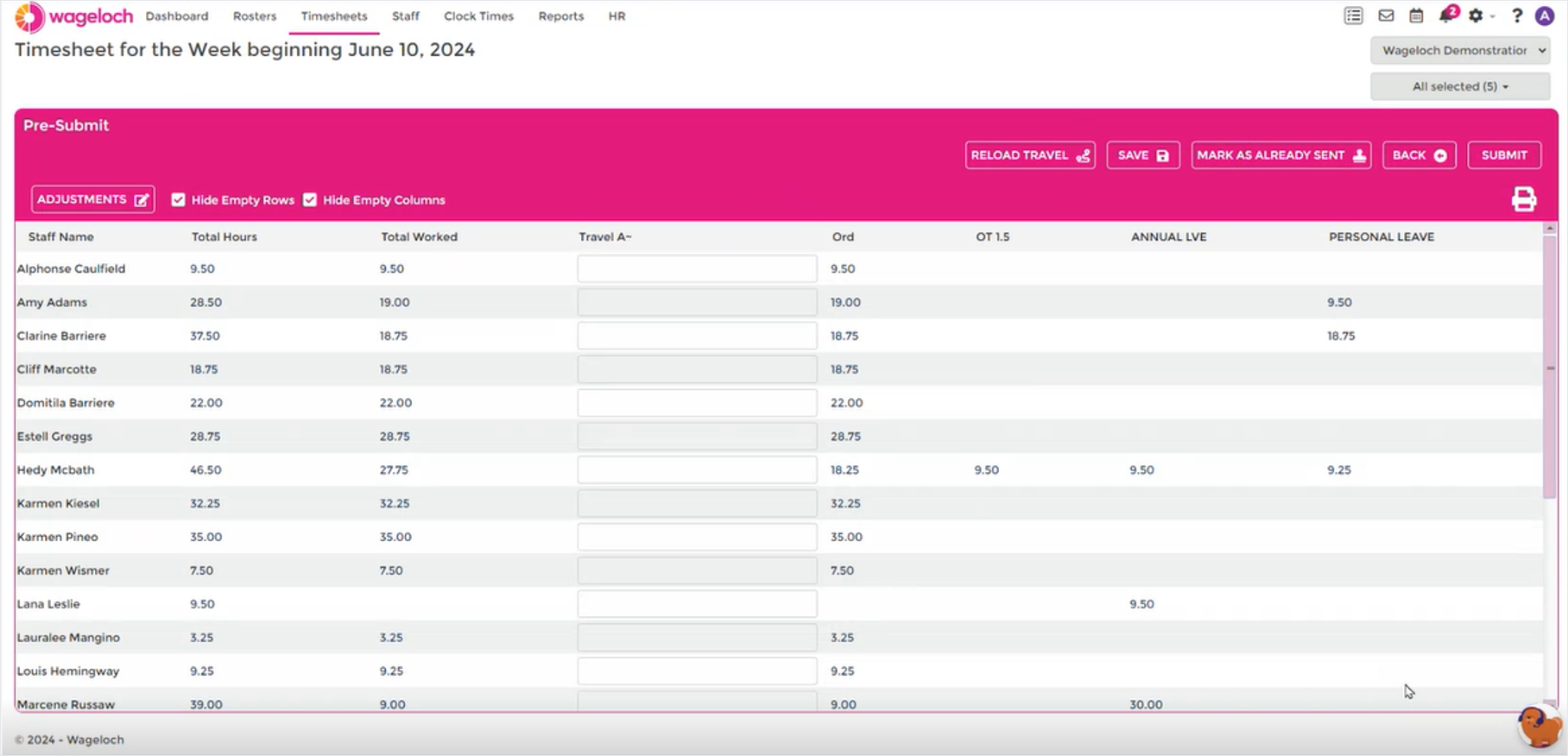

- Review your Timesheets in Wageloch to ensure they are accurate

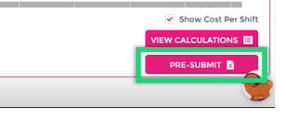

- Click the Pre-Submit button at the bottom right of the screen

- Review the Pre-submssion Report to ensure it is accurate and make any changes as required

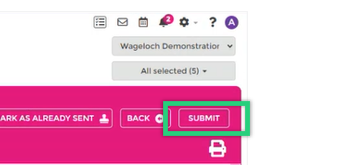

- Click the Submit button at the top right to push the data into Ready pay (powered by Aussiepay)

- The data is now available in the Ready pay (powered by Aussiepay) payroll screen

Note: In order to use this integration you will need to have the API add-on as part of your Ready pay (powered by Aussiepay) subscription.

Common File Import Errors

Truncation errors for all rows, listing ‘NumPays’ as the erroring column

Example:

Bulk load data conversion error (truncation) for row 1, column 9 (NumPays).Bulk load data conversion error (truncation) for row 2, column 9 (NumPays).Bulk load data conversion error (truncation) for row 3, column 9 (NumPays).Bulk load data conversion error (truncation) for row 4, column 9 (NumPays).Bulk load data conversion error (truncation) for row 5, column 9 (NumPays).Bulk load: An u

The file format on your account is incorrectly configured. Please contact your Payroll Consultant to request your format be set to ‘CSV Format with Alt Rate’.

A single or couple of truncation errors only

Example:

Bulk load data conversion error (truncation) for row 3, column 3 (Paycode_ID) .Warning: Null value is eliminated by an aggregate or other SET operation.Warning:Null value is eliminated by an aggregate or other SET operation.Create Pay Sheet

One or more fields in your file are longer than is allowed. Code fields are usually limited to 10 characters, date fields are limited to 8 characters.

You will need to correct the file and any system where the file was produced, then upload it again.

Invalid Paycode ID

Example:

The Paycode_ID (1000077222) for employee (37) is not valid.

Either the paycode ID does not exist on your account or it exists but it is not available in the employee’s payment group. If the paycode ID does not exist, you will need to correct the configuration in the third party system where you produced the import file. If the paycode ID does exist on your account, ensure it is available in the affected employee’s payment group.

Date/Time conversion error

Example:

Conversion failed when converting date and/or time from character string.

This error indicates that there are one or more rows in the file which have an incorrectly formatted date. All date fields should be formatted as DDMMYYYY.

This error commonly occurs where a file has been opened/saved in Excel and leading zeros have been removed from a date. For example, 03/09/2020 should be in the file as 03092020 however if the file is opened then saved in Excel, Excel removes the leading zero and the value incorrectly becomes 3092020. In this case, you should either:

- Produce a new file to upload

- Manually edit the file in Notepad or Notepad++ to add in the missing leading zeros.