IMPORTANT: Some details relating to the extension of the JobKeeper program are yet to be formally confirmed by the Australian Taxation Office. As such, some of the following instructions relating to the extension period may change.

In this topic

- Introduction

- Important Information

- 1. Scenarios

- 2. Registering Employees for JobKeeper

- 3. Configuration

- 4. Running Payroll

- JobKeeper Frequently Asked Questions

Introduction

The following instructions will help you configure your ePayroll platform for JobKeeper Payments.

Important Information

Before making any JobKeeper payments you as the employer should check that both you and your employees are eligible to receive the JobKeeper payments. Additionally, the employee has nominated you as their “Primary JobKeeper Employer.

For assistance in determining if or when your business may be eligible for JobKeeper you should consult your accountant or the ATO. ePayroll cannot assist you in determining your business’s eligibility for JobKeeper.

Additional details on the JobKeeper program can be found on:

- The Treasury’s website: https://treasury.gov.au/coronavirus/jobkeeper.

- The ATO website: https://www.ato.gov.au/general/JobKeeper-Payment/

Employers can enrol for JobKeeper via their ATO Business Portal or their Accountant.

The ATO are yet to announce how they will be managing the variable JobKeeper payments that are effective of 28th September. We will provide updates once this process is known.

1. Scenarios

You may find you have employees in one or more scenarios, each of which is dealt with slightly differently in each instance.

Consider each scenario below:

Scenario 1- Normal Employee earning over the JobKeeper minimum per fortnight

In this scenario you do not need to make any changes to your payroll system when paying this employee. The JobKeeper reimbursement from the ATO is simply a payment to the business to assist you in paying the employee.

Scenario 2- Employee earning less than the JobKeeper minimum per fortnight

In this scenario you will pay your employee their standard pay and will “Top Up” their pay so that it is at least the JobKeeper minimum payment before tax per fortnight

i.e. Employee works 25 hours in the fortnight at $20 per hour = $500 Gross pay. While the JobKeeper Minimum payment is $1,500

Pay would include:

- Their 25 hours against their normal hours pay code = $500

- An amount of $1,000 to the JOBKEEPER-TOPUP Pay code

Scenario 3- Employees stood down

In this scenario the employees are not currently working any hours so will not receive any normal pay. Note: When employees are stood down under the Fair Work Act, they should receive their full leave entitlements.

This employee would be configured to receive:

- $1,500 payment to the JOBKEEPER-TOPUP Pay code.

- $0 against a Stand Down Pay code with their normal number of hours.

Scenario 4- Employee stood down with an additional top up

In this scenario you agreed to you pass the whole $1,500 JobKeeper payment onto the employee while allowing them to Top Up their wages using some of their Annual leave during the period they are stood down or are on reduced hours.

NOTE:: Scenario 4 is a generous option and is not one of the government examples. Technically you can ask the employee to take leave for the total value they wish to receive per fortnight, and it would then be processed as per Scenario 1.

This pay would be configured to receive:

- $1,500 Payment against the JOBKEEPER-TOPUP Pay code

- $XXXX against annual leave at Y hours

- $0 against Stand down Pay Code for the difference between Y hours and their normal hours.

2. Registering Employees for JobKeeper

To register an eligible employee for JobKeeper with the ATO you need to send a message via STP:

The process to register an employee once they have nominated you is to process a payment of 1 cent against a Special Allowance Paycode that relates to the first fortnight the business will be claiming JobKeeper for the employee. If you pay your employees monthly, it is important that you specify the fortnight that the employee BECAME eligible, not the fortnight in which the employee received their first pay.

There may be instance where you need to stop claiming JobKeeper for an employee. This may include resignation, terminations or periods where an employee receives Paid Parental leave. When this happens, you need to make a 1 cent payment to the JOBKEEPER-END-FNxx that relates to the first fortnight the business will not be claiming JobKeeper for the employee. In most cases this will be the fortnight after the employee finishes.

Note: Termination Payments can not be included in the JobKeeper Minimum fortnightly Payments.

The 1 cent payments only need to be paid to the employee once.

Show ATO Fortnights and Payment Amounts

| ATO Fortnight | ATO Dates | Jobkeeper Payments |

|---|---|---|

| FN01 | 30/03/2020-12/04/2020 | $1,500 |

| FN02 | 13/04/2020-26/04/2020 | $1,500 |

| FN03 | 27/04/2020-10/05/2020 | $1,500 |

| FN04 | 11/05/2020-24/05/2020 | $1,500 |

| FN05 | 25/05/2020-07/06/2020 | $1,500 |

| FN06 | 08/06/2020-21/06/2020 | $1,500 |

| FN07 | 22/06/2020-05/07/2020 | $1,500 |

| FN08 | 06/07/2020-19/07/2020 | $1,500 |

| FN09 | 20/07/2020-02/08/2020 | $1,500 |

| FN10 | 03/08/2020-16/08/2020 | $1,500 |

| FN11 | 17/08/2020-30/08/2020 | $1,500 |

| FN12 | 31/08/2020-13/09/2020 | $1,500 |

| FN13 | 14/09/2020-27/09/2020 | $1,500 |

| FN14 | 28/09/2020-11/10/2020 | $1,200 / $750 |

| FN15 | 12/10/2020-25/10/2020 | $1,200 / $750 |

| FN16 | 26/10/2020-08/11/2020 | $1,200 / $750 |

| FN17 | 09/11/2020-22/11/2020 | $1,200 / $750 |

| FN18 | 23/11/2020-06/12/2020 | $1,200 / $750 |

| FN19 | 07/12/2020-20/12/2020 | $1,200 / $750 |

| FN20 | 21/12/2020-03/01/2021 | $1,200 / $750 |

| FN21 | 04/01/2021-17/01/2021 | $1,000 / $650 |

| FN22 | 18/01/2021-31/01/2021 | $1,000 / $650 |

| FN23 | 01/02/2021-14/02/2021 | $1,000 / $650 |

| FN24 | 15/02/2021-28/02/2021 | $1,000 / $650 |

| FN25 | 01/03/2021-14/03/2021 | $1,000 / $650 |

| FN26 | 15/03/2021-28/03/2021 | $1,000 / $650 |

The Start & End Paycode templates in ePayroll will be updated each fortnight on the Tuesday to match the Start & Ends that would be needed for that Fortnight.

If you need to register or remove an employee for a different period, email jobkeepersupport@epayroll.com.au with the required information and we will add the custom paycode to your setup. (Please allow 48 hours for this to be actioned)

If you make a mistake in sending 1 cent JOBKEEPER START or END payments to the wrong fortnight please email jobkeepersupport@epayroll.com.au for advice on how to fix your mistake.

3. Configuration

Determine which paycodes you will require from the above scenarios.

1. Add Paycodes to your configuration

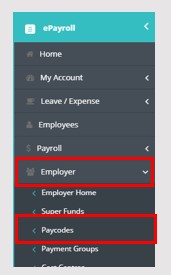

After logging into ePayroll, go to Employer – Paycodes:

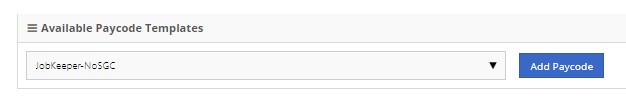

Select the Paycodes in the drop down and click Add Paycode:

- JobKeeper = JobKeeper-NoSGC

- Stand Down = Stand Down Hours

- JOBKEEPER-START-FNxx or JOBKEEPER-END-FNxx *

If you require a different START or END fortnight than the one displayed in the drop down list, email jobkeepersupport@epayroll.com.au and this step will be done for you with the custom paycode.

NOTE: As per government guidelines, the JobKeeper paycode does not attract Superannuation. If you wish to pay Superannuation on JobKeeper payments please request this by emailing jobkeepersupport@epayroll.com.au.

IMPORTANT: Once added DO NOT change the description of the paycode. If the description is changed from “JOBKEEPER-TOPUP” your payments from the ATO may be delayed.

2. Add the Paycodes to Payment Group

Employer – Payment Groups

Repeat for each Payment group that requires the paycodes to be added to them.

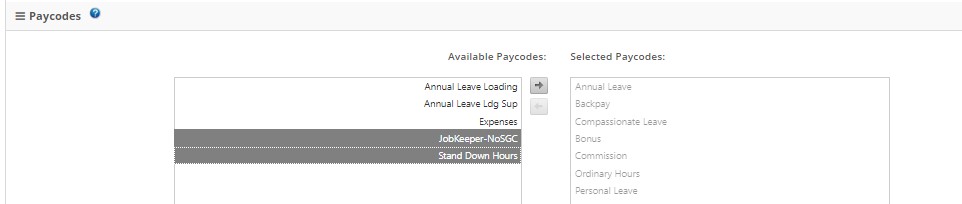

Click Edit, Scroll to the bottom and Add the PayCodes to the payment group by selecting them and clicking the arrow to move them to the right-hand box.

Scroll to the bottom and click the Save Changes button.

3. Add Paycodes to Employees

Employees Repeat for each employee that needs the appropriate paycodes.

Select Employees from the main menu

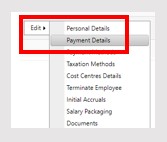

Click Edit next to the employee’s name and select Payment Details

Scroll down the page and tick the appropriate paycodes

4. Running Payroll

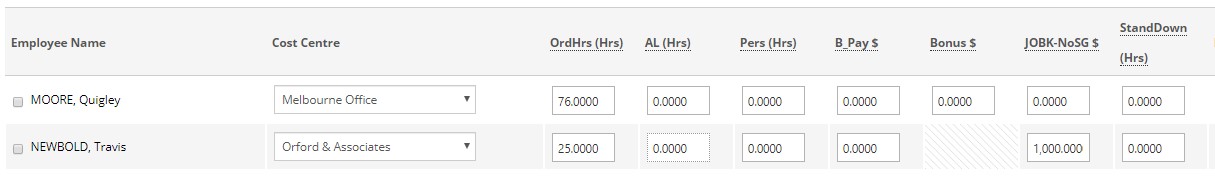

Scenarios 1 and 2

When running your payroll, you will need to manually update the figures in the corresponding paycodes.

In this instance MOORE, Quigley is a full-time employee working their normal hours (Scenario 1)

- earning their normal salary from 76 OrdHrs

NEWBOLD Travis is a part-time employee (Scenario 2)

- earning $500 salary from 25 OrdHrs

- receiving $1,000 against JOBK-NoSG – Top up payment

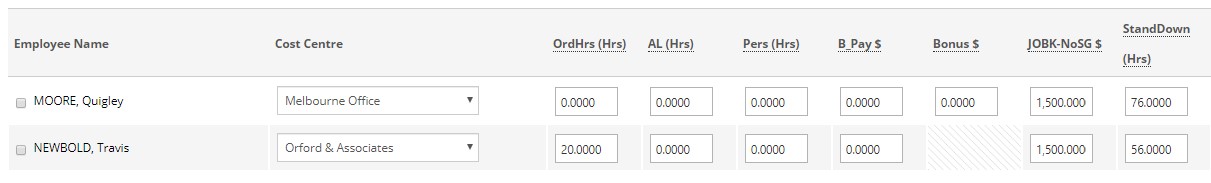

Scenarios 3 and 4

In this instance: MOORE, Quigley is a full-time employee that has been stood down (Scenario 3)

- receiving $1,500 against JOBK-NoSG

- Accruing annual leave against 76 Stand Down Hours @ $0

NEWBOLD, Travis is a full-time employee that has been stood down but topping up payment (Scenario 4)

- receiving $1,500 against JOBK-NoSG

- Topping up with 20 hrs of AL

- Accruing leave against 56 Stand Down hours at $0

Once updated as required – process the rest of your payroll as normal. If you require more information regarding options available to your business and your specific situation, you should contact:

- Fair Work

- Your Accountant

- A Workplace Lawyer